Pets, just like us, require regular medical attention to stay healthy and vibrant. Yet, the reality is, some veterinary treatments can be incredibly costly, even shockingly so. In this article, we’re going to dive into the five most expensive veterinary treatments you might encounter, and crucially, explore the reimbursement options available. Understanding these potential financial hurdles and how to navigate coverage can genuinely help pet owners better prepare their budgets and make informed, compassionate care decisions for their beloved companions.

Here’s what most people don’t realize: the average pet owner will face at least one major veterinary expense exceeding €1,000 during their pet’s lifetime. This isn’t meant to scare you—it’s meant to empower you with knowledge so you can plan ahead and ensure your furry family member gets the care they deserve without breaking the bank.

1. Orthopedic Surgery: Restoring Mobility, Reclaiming Joy

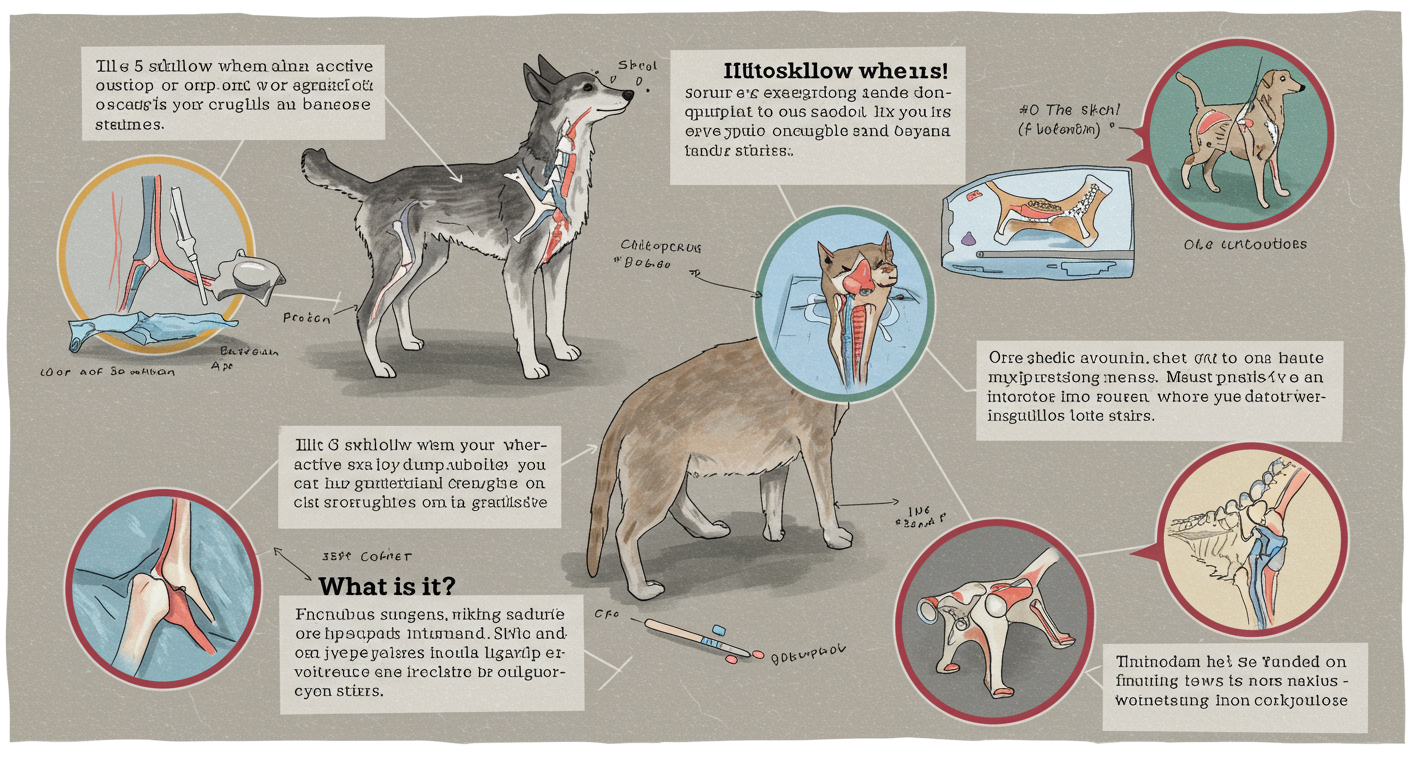

Orthopedic issues are surprisingly common in our furry friends, often stemming from playful tumbles, genetic predispositions, or the natural wear and tear of aging. It’s a tough pill to swallow when your active dog suddenly can’t jump, or your graceful cat struggles with stairs.

What Is It?

Orthopedic surgeries involve intricate procedures on bones, joints, and ligaments.

- What is the prognosis with and without treatment?

- What will my pet’s quality of life be during and after treatment?

- Are there less expensive alternative treatments?

- What is the timeline for decision-making?

- Are there payment plans or financial assistance programs available?

Financial Assistance Resources

Many organizations provide financial assistance for pet medical care:

- Veterinary schools often offer reduced-cost care

- Charitable organizations like RedRover and The Pet Fund provide grants

- Some veterinary practices offer payment plans or work with financing companies

- Clinical trials may provide free or reduced-cost cutting-edge treatments

Insider secret: Don’t be embarrassed to discuss financial constraints with your veterinarian. Most are willing to work with you to find solutions that fit your budget while still providing good care for your pet.

The Value of Second Opinions

For major diagnoses or expensive treatment recommendations, seeking a second opinion can be valuable:

- Confirms the diagnosis and treatment plan

- May reveal alternative treatment options

- Can provide cost comparisons

- Offers peace of mind in decision-making

What works: Many insurance policies cover second opinions, recognizing their value in ensuring appropriate care.

Preventive Care: Your Best Investment

While we’ve focused on expensive treatments, the most cost-effective approach to pet healthcare is prevention. Investing in preventive care can help avoid many of the expensive conditions we’ve discussed.

The Preventive Care Checklist

Annual Wellness Examinations:

- Early detection of health issues

- Vaccination updates

- Parasite prevention

- Weight management counseling

- Cost: €100-200 annually

Dental Care:

- Regular brushing

- Professional cleanings as recommended

- Dental treats and toys

- Early intervention for dental disease

- Prevention cost: €50-300 annually vs. treatment cost: €500-2,500

Nutrition and Weight Management:

- High-quality diet appropriate for life stage

- Portion control

- Regular exercise

- Obesity prevention (reduces risk of diabetes, arthritis, heart disease)

Parasite Prevention:

- Flea and tick prevention

- Heartworm prevention

- Regular deworming

- Cost: €200-400 annually vs. treatment costs: €500-3,000+

Try this and see the difference: Keep a health journal for your pet, noting any changes in behavior, appetite, or activity level. Early detection of problems can significantly reduce treatment costs and improve outcomes.

The Future of Veterinary Care: Trends and Innovations

The veterinary field is rapidly evolving, with new technologies and treatments becoming available regularly. Understanding these trends can help you make informed decisions about your pet’s care and insurance coverage.

Technological Advances

Telemedicine: Virtual consultations are becoming more common, potentially reducing costs for routine follow-ups and minor concerns.

Advanced Diagnostics: New imaging techniques and genetic testing are improving early detection and treatment planning.

Minimally Invasive Procedures: Laparoscopic surgery and other minimally invasive techniques are reducing recovery times and costs.

Personalized Medicine: Genetic testing is enabling more targeted treatments, potentially improving outcomes while reducing unnecessary treatments.

Insurance Evolution

Wellness Integration: More policies are including routine care as standard coverage rather than add-on options.

Technology Integration: Apps and digital platforms are making it easier to manage claims and track your pet’s health.

Flexible Coverage: Customizable policies that allow you to adjust coverage based on your pet’s changing needs.

Alternative Therapies: Coverage for acupuncture, chiropractic care, and other alternative treatments is becoming more common.

Game-changer insight: The pet insurance industry is becoming more competitive, which benefits consumers through better coverage options and more reasonable pricing.

Key Points and Best Practices: A Framework for Financial Wellness

Navigating the world of pet healthcare costs can feel overwhelming, but with a proactive approach, you can ensure your companion receives the best care without undue financial stress.

Get Smart About Insurance: Don’t just “get insurance”; choose a policy that genuinely fits your pet’s breed, age, and potential predispositions. Look for plans that cover common veterinary care, emergency situations, and ideally, offer wellness add-ons for preventive care like dental cleanings. Trends in pet insurance show a move towards more customized coverage and a greater emphasis on preventive care, so explore these flexible options.

Prevent Rather Than Cure: This isn’t just a cliché; it’s a powerful financial strategy. Investing in regular health check-ups, appropriate vaccinations, and consistent dental care can prevent minor issues from escalating into far more expensive, life-threatening conditions. As the adage goes, “an ounce of prevention is worth a pound of cure.”

Know Your Limits (and Your Policy’s): Be intimately aware of your insurance policy’s coverage limits, deductibles, reimbursement percentages, and, crucially, any treatment exclusions or waiting periods (especially for orthopedic conditions). A thorough understanding avoids unpleasant surprises when you need coverage most.

Budget for Care: The “Pet Health Fund” Mental Model: Consider adopting a budgeting framework like the “Pet Health Fund.” This isn’t necessarily a strict rule, but rather a mental model where you consistently set aside a dedicated amount each month into a separate savings account specifically for your pet’s care. This fund acts as a buffer for both routine expenses and those inevitable unexpected emergencies, offering true peace of mind.

Build Relationships with Your Veterinary Team: Establish a relationship with a primary veterinarian and understand the emergency care options in your area. Good communication with your veterinary team can help you make informed decisions and potentially identify cost-effective treatment alternatives.

Stay Informed: Keep up with advances in veterinary medicine and changes in insurance offerings. What wasn’t covered or available last year might be standard today.

Plan for the Long Term: Consider your pet’s entire lifespan when making insurance and financial decisions. A young, healthy pet might not need extensive coverage immediately, but having it in place prevents exclusions for conditions that develop later.

Conclusion: Empowering Pet Parents for a Lifetime of Care

The reality is, veterinary care can be costly, but the financial burden doesn’t have to dictate the quality of care your cherished companion receives. By understanding the most expensive treatments, proactively exploring reimbursement options like pet insurance, and wisely budgeting for your pet’s needs, you empower yourself to make the best possible decisions for your furry family member.

The key is preparation and education. The pet owners who navigate expensive veterinary treatments most successfully are those who have planned ahead, understand their options, and have built financial safety nets through insurance and savings. They’re able to focus on what matters most—their pet’s health and comfort—rather than being overwhelmed by financial concerns.

Remember that every pet is unique, and what works for one family might not work for another. The important thing is to have a plan that fits your situation and gives you confidence that you can provide excellent care for your pet throughout their lifetime.

Take the time to inform yourself, prepare for the future, and ensure your four-legged family member enjoys a long, healthy, and happy life by your side. The investment you make in understanding and preparing for veterinary costs today will pay dividends in peace of mind and your pet’s wellbeing for years to come.

What aspects of pet health care do you find most challenging to plan for, and how might a dedicated “Pet Health Fund” change your approach to ensuring your pet receives the best possible care throughout their lifetime?